Georgia tax paycheck calculator

Well do the math for youall you need to do is enter. Your household income location filing status and number of personal.

2022 Salary Paycheck Calculator 2022 Hourly Wage To Yearly Salary Conversion Calculator

The Salary Calculator is an excellent tool for identifying how your payroll deductions and income taxes are split up with details of how each is calculated and the percentage of your salary that.

. Georgia Hourly Paycheck Calculator Results Below are your Georgia salary paycheck results. Georgia Income Tax Calculator 2021 If you make 70000 a year living in the region of Georgia USA you will be taxed 11993. This includes tax withheld from.

Figure out your filing status. This Georgia hourly paycheck. Calculate FUTA Unemployment Tax which is 6 of the first 7000 of each employees taxable income.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Georgia. Let us explain how to calculate your withholdings in an example. To use our Georgia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Thats why it is a bit easy to calculate your paycheck in Georgia. Updated for 2022 tax year. Lets assume your annual pay is 52623.

Calculate your total income taxes. The Georgia bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Paycheck Results is your gross pay and specific.

Ad Our Resources Can Help You Decide Between Taxable Vs. Get Your Quote Today with SurePayroll. This Georgia bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses.

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking To calculate a. Enter Your Salary and the. Calculating your Georgia state income tax is similar to the steps we listed on our Federal paycheck calculator.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Just enter the wages tax withholdings and other information required. Get Started Today with 2 Months Free.

All Services Backed by Tax Guarantee. With just a few clicks the Gusto Georgia Hourly Paycheck Calculator shows you how payroll taxes are calculated. Federal Georgia taxes FICA and state payroll tax.

Deduct and match any FICA taxes. Work out your adjusted gross income. Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Georgia. Ad Payroll So Easy You Can Set It Up Run It Yourself. The results are broken up into three sections.

Skip to main content. The state income tax rate in Georgia is progressive and ranges from 1 to 575 while federal income tax rates range from 10 to 37 depending on your income. Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Withholding tax is the amount held from an employees wages and paid directly to the state by the employer. Follow these simple steps to calculate your salary after tax in Georgia using the Georgia Salary Calculator 2022 which is updated with the 202223 tax tables.

After a few seconds you will be provided with a full breakdown. And our comprehensive payroll packages make calculating your payroll. Ad Looking for ga payroll calculator.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Paycheck Manager provides a FREE Payroll Tax Calculator with a no hassle policy. Your average tax rate is 1198 and your marginal tax rate is.

Content updated daily for ga payroll calculator.

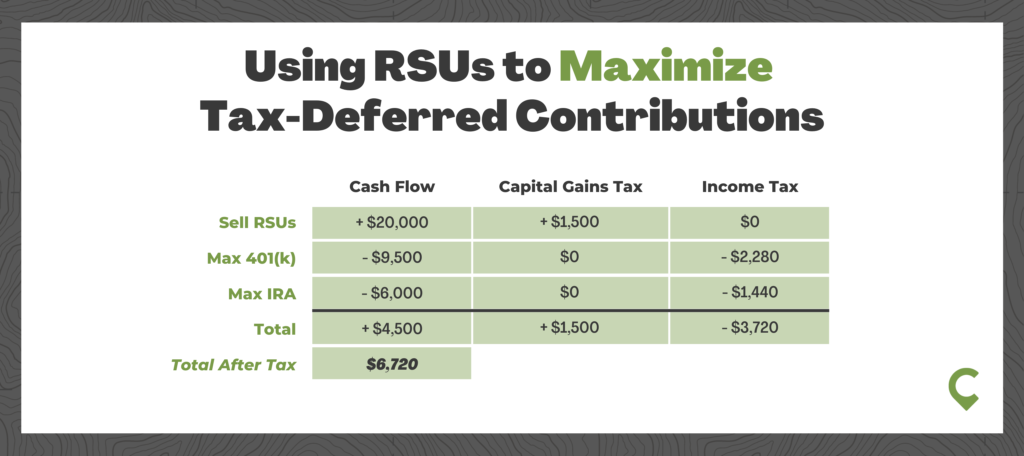

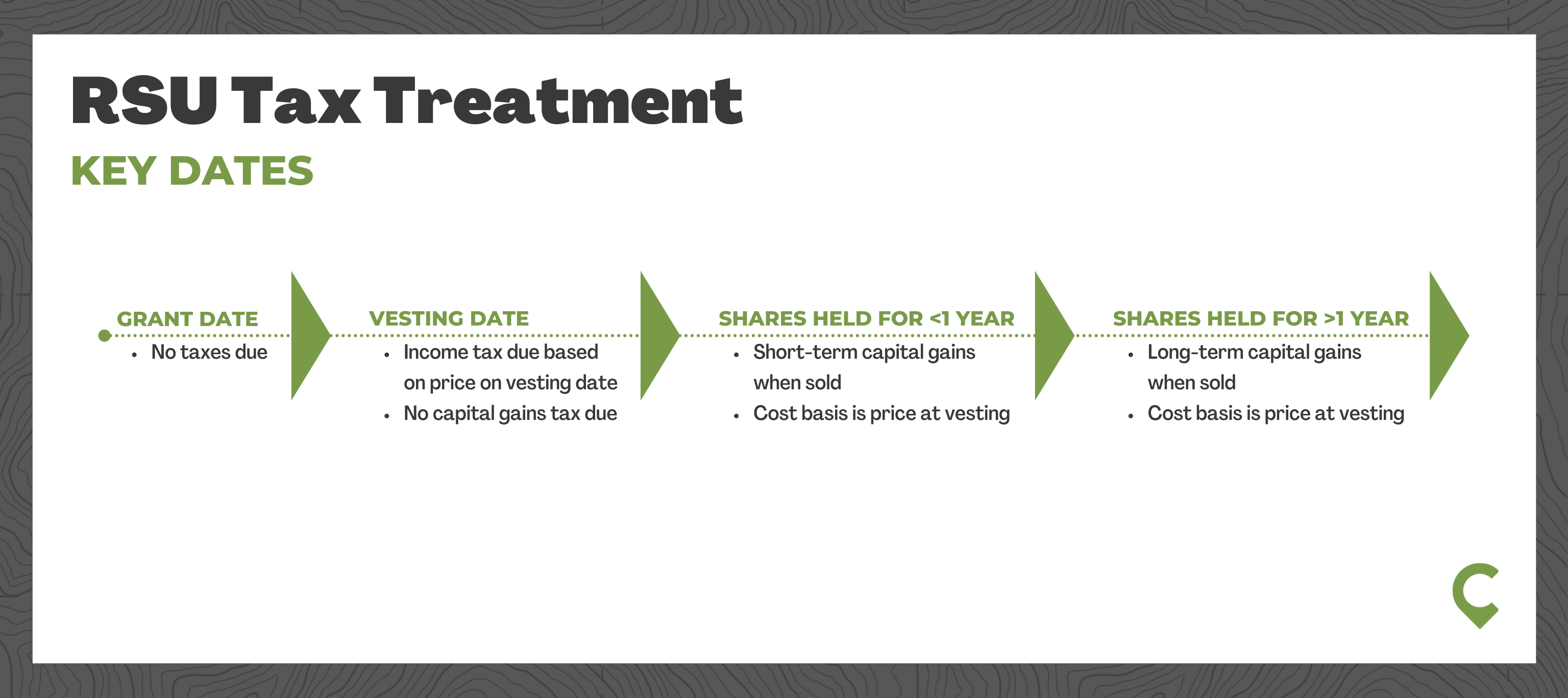

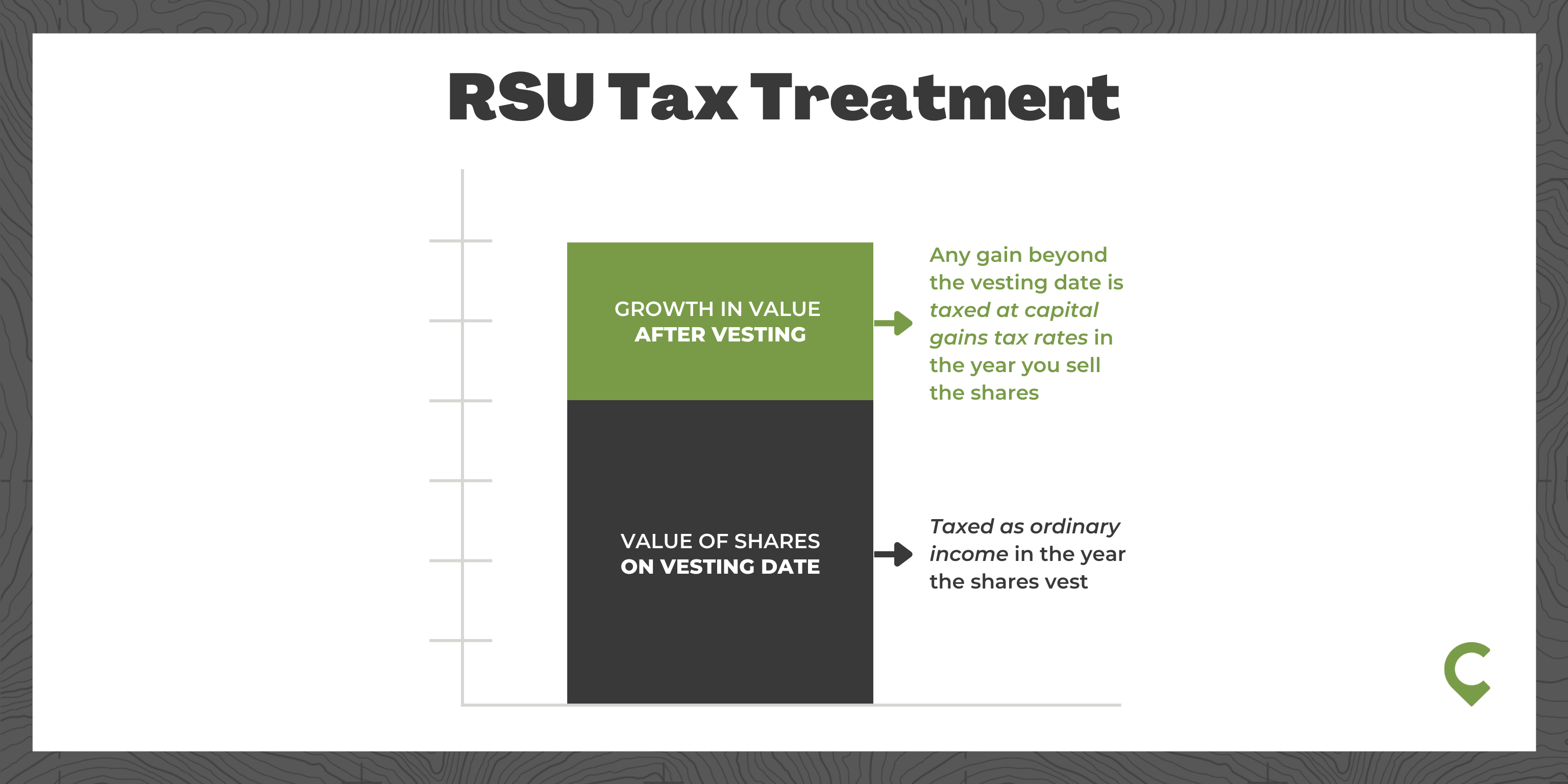

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Taxes Explained 4 Tax Strategies For 2022

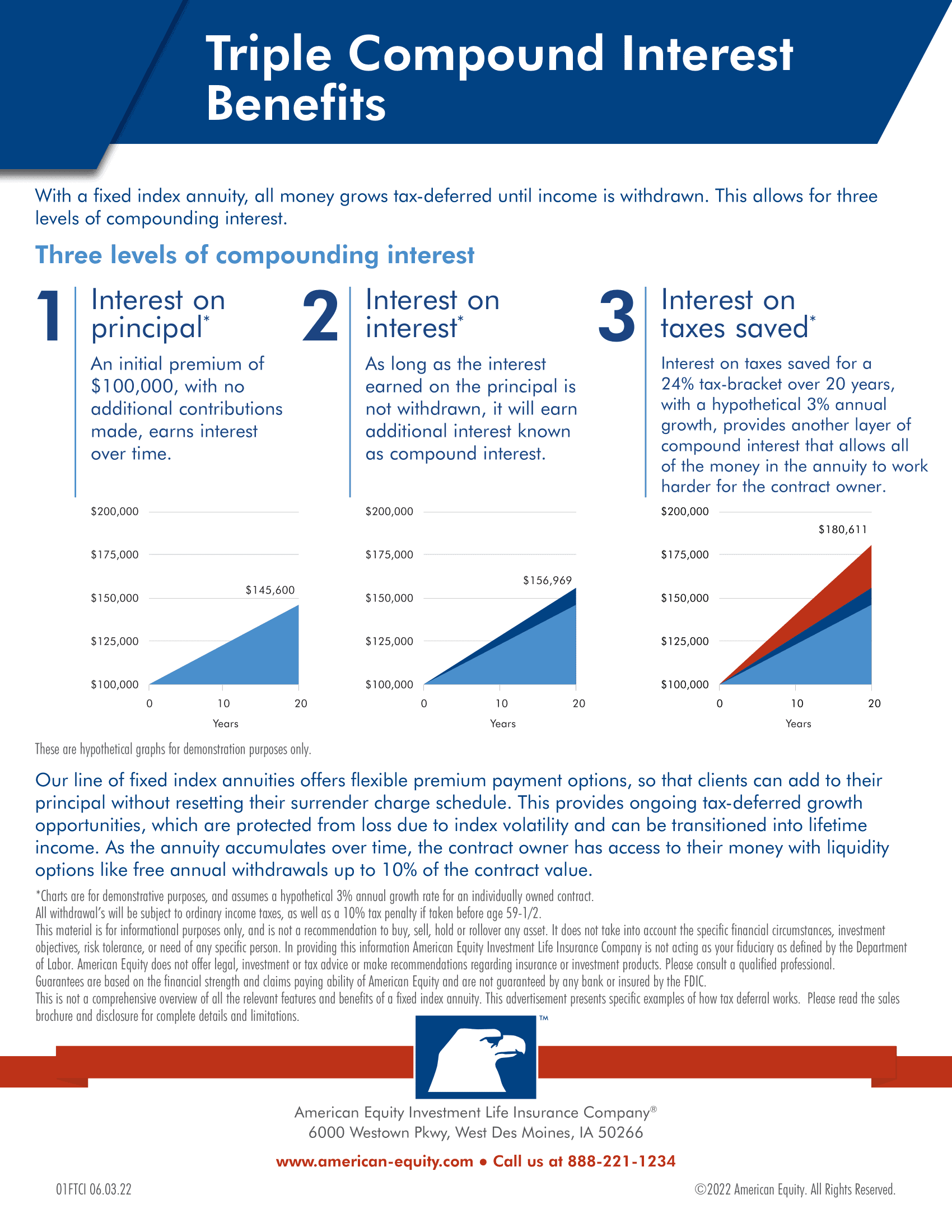

Compound Interest Calculator Daily Monthly Quarterly Annual

Georgia Property Tax Calculator Smartasset

Is Property Tax The Same As Paying Rent To The Government Can I Actually Own Property In The United States Quora

Cobb County Assessor S Office Cobb County Cobb County

Bonus Calculator Percentage Method Primepay

Flat Bonus Pay Calculator Flat Tax Rates Onpay

![]()

Self Employment Tax Calculator Estimate Your 1099 Taxes Jackson Hewitt

Rsu Taxes Explained 4 Tax Strategies For 2022

Is Property Tax The Same As Paying Rent To The Government Can I Actually Own Property In The United States Quora

2022 Salary Paycheck Calculator 2022 Hourly Wage To Yearly Salary Conversion Calculator

Rsu Taxes Explained 4 Tax Strategies For 2022

Calculate Credit Card Balance Credit Card Interest Rate Ideas Of Credit Card Interest Rate Creditcard Interestra Dave Ramsey Budgeting Finances Budgeting

Is Property Tax The Same As Paying Rent To The Government Can I Actually Own Property In The United States Quora

Self Employment Tax Calculator Estimate Your 1099 Taxes Jackson Hewitt

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary